Safe Guarded & Protected from market volatility

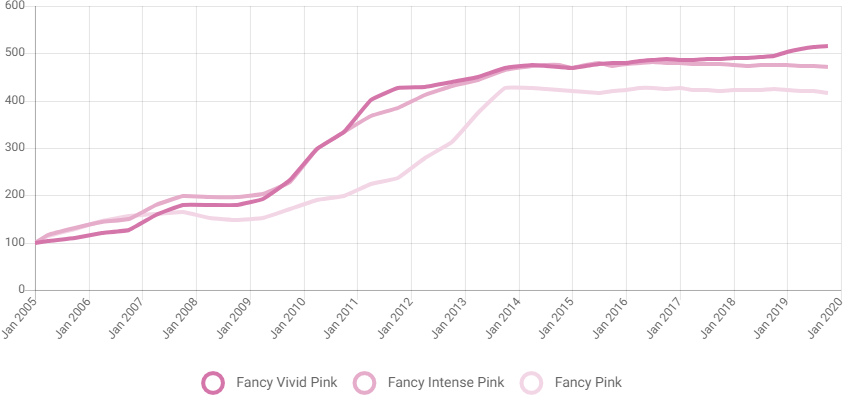

From the beginning of the 70’s, prices for the highest grades of colored diamonds increased between 10 to 20% per year on average, with the best colors and highest grades accumulating the most growth in value.

One major observation has shown that growth in Fancy Color Diamonds is uncorrelated to the financial markets, an essential strategy for those searching for a diversified approach to wealth creation.

Fancy Color diamonds do not have the same volatility as the financial and commodity markets. In upward trending periods, diamond prices increase in value steadily, and when we see an economic downward trend or recession, prices often stay stable. They do not fall.

In 2008, we saw the Global Financial crisis. However, pink diamond prices held particular well; buyers of these precious Gems held onto the assets of diamonds unaffected. As a result, in 2010 new buyers came in droves to this hard asset safe haven as the markets started to recover from the Global Financial Crises.

This makes the pink diamond a very rare stone, destined to become less and less naturally available.

Source: Fancy Color Research Foundation.

Proof Fancy Color Diamonds can act as a measure of Financial Insurance against economic turmoil.

What reasons do Fancy Color Diamonds give against volatility?

Data shows that geopolitical economic instability causes the financial markets to fluctuate and when major world currencies plunge and others become more resilient. Commodities show increased unstableness; when oil dropped negative in 2020, its lowest drop ever recorded, iron ore lost more than half its value. Gold had its third straight annual loss in 2015, for the first time since 1998.

This volatility has spurred individuals to search for something different, and as the data proves, Fancy color diamonds show stability.

Rare Fancy color diamonds do not see the exact sentiment of swings as the financial markets; Fancy Color Diamonds offer to protect investment-grade diamond buyers from the volatility of market risk.

With a longer-term view, rare fancy coloured diamonds are finite with no new diamond mines found and an ever-diminishing supply from current live mining operations. Nevertheless, the basic supply and demand economy proves a good case for this asset class.

As a result, colored diamonds have solid and consistent returns for short-mid and long-term holders.

Diversify from traditional investments

In retrospect of diversified strategy, most individuals have varied Investments. For example, most individuals have stock market shares, property, or government bonds.

Individuals also hold fiat currency in the banking system and term deposits; interest rates are meagre and could stay that way for the future. As a result, many individuals search for other options; buying more of the same assets would further increase risk.

Advisors are now advising alternatives such as rare fancy colored diamonds, as an alternative can provide a better yield than having savings in a bank with the real chance of interest rates turning negative or not much increasing at all.